Millions of Americans only have enough money set aside to cover $400 of emergency expenses.

If you’re one of theses people, you can’t afford to have something go wrong with your pay stub. Otherwise, you might not be able to cover bills and other necessities for the month.

We’ve put together this guide to teach you how to read a pay stub the right way. Once you know how to do this, you can stay on top of your records and make sure you’re getting every penny you earn every paycheck.

Keep reading below to learn the three important things you need to understand about your pay stubs.

- Understanding Gross Pay

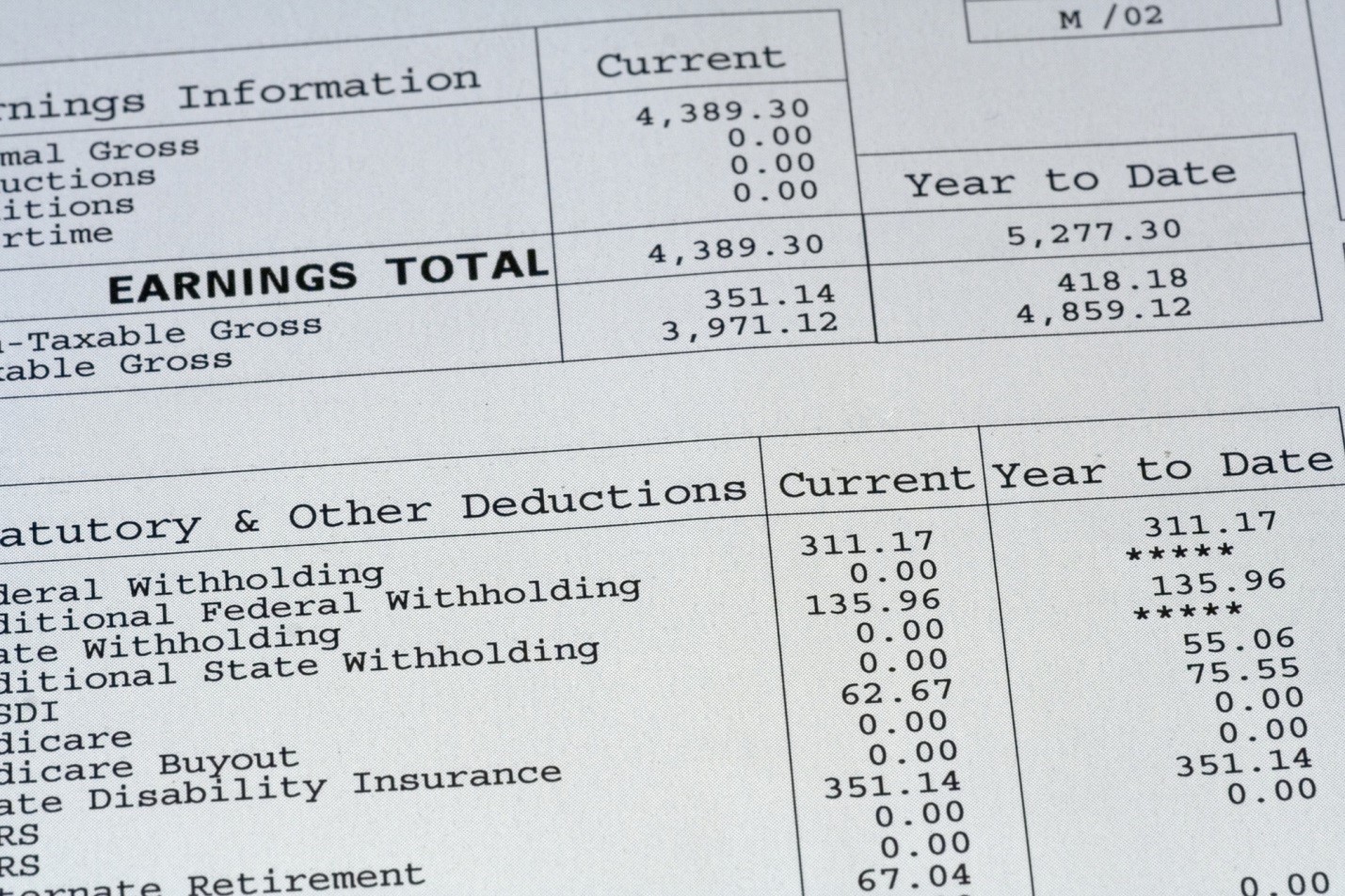

Start by finding the “gross pay” section on your pay stub. This number shows the total amount of income you made this pay period. It adds up your salary or hourly pay along with any other form of income you made, including overtime, reported tips, bonuses, etc.

You may also see another number marked as “YTD.”

This stands for “year to date,” and it shows the total amount of money you’ve made so far this year. Because of this, the YTD number will often be much larger than your gross pay.

So don’t get confused.

If you mix up the two numbers, you might be in for a rude awakening later.

And don’t worry if you don’t see the YTD number in this section. Some pay stubs record this number in a different section. However, it will be on your pay stubs somewhere.

- Go Over Your Deductions

The next thing you’ll see on real check stubs is deductions. You might see this broken up into two different sections: taxes and other deductions. However, these two things are often recorded under the same section.

The exact type and amount of deductions you’ll see on your pay stub depend on your personal circumstances. Here’s a quick list of common pay stub deductions you might have.

Federal Income Tax

If you’re a citizen of the United States, you’ll have federal income tax taken out of your paycheck.

Again, the exact amount you’ll see in this section will vary depending on your personal information, such as how much money you make and how many dependents you have (if any). Using this information, your employer will estimate the amount of federal income tax you’ll have to pay over the year and divide it by the number of paychecks you’ll get during that time.

They’ll then deduct the number they end up with from your gross pay.

Social Security Tax

You are also required to pay social security tax if you’re an American citizen. This money gets put into the social security system then, when you’re ready to retire, you can get this money back in monthly payments.

Social security tax will be about 6.2% of your total paycheck.

State Tax

Some places mandate that employers take state tax from your paycheck as well. But this is only true in some states. Depending on where you live, you may not see this deduction on your pay stub.

Retirement

If you have a retirement plan through your employer, they’ll deduct some money from your gross earnings and put it into this fund. You can usually choose the percentage you want taken from your paycheck when you sign up for one of these plans.

You might see this deduction listed as 401K or IRA.

Insurance

Do you have any dental, medical, or other types of insurance through your employer? Your employer might pay part of the premiums for this insurance. However, anything they don’t pay, you will have to pay yourself.

Because of this, they will deduct a certain amount of money from your gross pay for the insurance you have.

Medicare

This is another deduction you’re required to pay as an American citizen. This will help cover any medical expenses you have over the years.

Your employer will deduct 1.45% of your gross income to cover Medicare. They will then also pay another 1.45% themselves on your behalf.

- Net Pay

The last section on your pay stub is the net pay. This is the amount of money you’re left with after subtracting all your deductions. Because of this, your net pay number will be smaller than your gross pay.

The net pay is the amount you get to take and put in your bank account.

You may also see the YTD term again. Like before, this will show you how much net earnings you’ve made so far this year. If it isn’t listed in the deductions section, you’ll also see a YTD deductions category.

It’s a good idea to do the math yourself to make sure your net pay is accurate. Add up all your deductions and subtract them from your gross earnings. If the number you get doesn’t match the number on your pay stub, make sure you talk to your employer.

They might have made a mistake somewhere along the way.

Understanding How to Read a Pay Stub the Right Way

It’s important to know how to read a pay stub. This allows you to keep track of how much you’re making and how many deductibles are being taken out of your paycheck.

Don’t put your pay stubs aside without looking them over first. It’s a good idea to do your own math and make sure everything is accurate.

Do you want some other helpful job tips?

Make sure you check out the rest of our blog!